How much do brokers charge to sell a business — and is it worth the cost?

The answer depends on several factors, including the size of your business and what type of advisor you work with.

While most business brokers work primarily on commission, fee structures can include various combinations of upfront fees, monthly retainers, and success fees.

Let’s break down how each of these fee structures work and how you might think about whether they make sense for the sale of your company.

But first, a word of caution. We see a lot of founders worry about the cost of a broker, when perhaps the more pressing consideration is slightly different: making sure you choose a good one.

A good M&A advisor can be worth the cost, because they’ll help you sell your business for more and guide you through all the tough parts.

And if you don’t have a buyer for your business, you might need a broker to help you sell it. A sale where you have to pay a broker is typically better than no sale at all.

An inexperienced advisor, though, is the real trap, and where founders sometimes wish they hadn’t spent the money.

Need help choosing an M&A advisor?

That’s what we’re here for! We’ll match you (for free) with an advisor who specializes in sales of your size.

Before we dive in, a quick note: we use the terms “broker” and “advisor” interchangeably throughout this post. (Most M&A professionals prefer to be called advisors rather than brokers, but most founders who look for a professional to help them sell use the term “broker” until they know better.)

What do business brokers and M&A advisors typically charge?

One of the first questions you should ask an M&A advisor when you’re figuring out whether to work with them is how their fees work. Because while there are some trends, all advisors charge differently.

Most business brokers work on a success-fee basis, meaning the bulk of their compensation comes when your business sells.

If you’re new to M&A, a good way to understand this is by comparing it to the sale of a house. If you work with a real estate agent, they only get paid when you sell the house. M&A success fees work similarly.

However, commission structures can vary significantly based on deal size and the broker’s model.

Many advisors use variations of the Lehman formula, sometimes known as the Lehman Scale, which typically follows this pattern:

- 10% of the first $1 million

- 8% of the second $1 million

- 6% of the third $1 million

- 4% of the fourth $1 million

- 2% of everything above $4 million

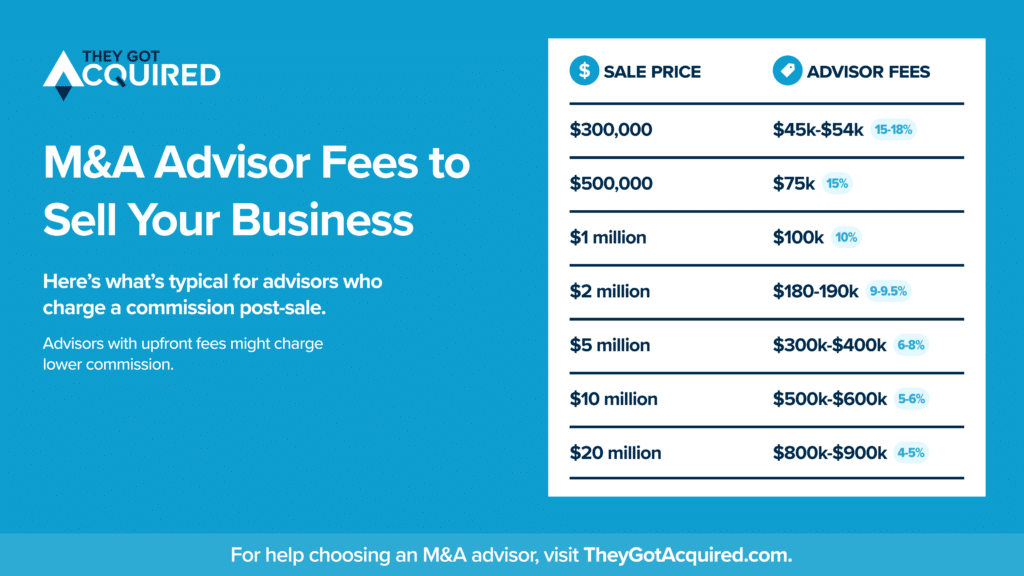

For smaller businesses (say, between $300,000-750,000), percentages may be higher, sometimes reaching 15-18%, to ensure the broker can dedicate sufficient resources to the deal.

Some brokers also have minimum fees to ensure the engagement is worth their time.

On the other end of the spectrum, some M&A advisors and investment bankers working on larger deals charge much lower percentages, with commissions ranging from 1-5% of the total deal value.

Here’s what that might look like in practice:

Success fee vs. monthly retainer vs. upfront fees

While nearly all M&A advisors charge a success fee or commission when your deal closes, some also require additional fees. Here’s what some of those fee structures look like.

Success fee only

- Typical for smaller deals

- Higher commission rates to compensate for risk

- Motivates the advisor to close the deal quickly

Monthly retainer + success fee

- Monthly fees can range from $500-$5,000 for 7 figure deals, and are typically more for 8 figure deals

- Lower success fee percentage since you’re paying some up front

- Fees continue as long as the business is listed

Upfront fee + success fee

- Upfront fees range from $1,000-$50,000, depending on deal size

- May be structured as initial valuation fee or preparation fee

- Some brokers credit upfront fees toward the final success fee

- Shows seller commitment and covers initial costs

- Often includes 3-4 months of active marketing

Why some brokers charge upfront fees

While some sellers balk at paying upfront fees, brokers cite several reasons for requiring them:

- Demonstrates seller commitment to the process

- Covers initial costs of valuation and marketing materials

- Ensures sellers are serious about realistic pricing

- Helps brokers invest resources in deals more likely to close

- Can lead to higher success rates, if sellers have more skin in the game

If you’re a seller choosing between an advisor who charges a success fee only vs. an advisor who also charges an upfront fee or monthly retainer, make a thoughtful choice that considers more than just cost.

A success-fee only model might be the best one for you. But sometimes it’s worth paying an upfront fee to work with an advisor who has specific experience that’s relevant to your sale or a personality that could facilitate a trusting partnership.

Can you negotiate broker fees?

Fee negotiation practices vary widely among brokers. Some engage in this practice, and some are firm against it.

It’s worth asking whether fees are negotiable when:

- You bring your own buyer (some brokers offer discounts)

- You have multiple businesses to sell

- You need limited services (some brokers offer “lite” packages)

- For larger deal sizes, the commission might be negotiable

- For smaller deals, sometimes the upfront fee is negotiable

So is it worth paying fees to hire an M&A advisor?

That depends on your goals, as well as the needs of you and your business.

We often recommend founders work with an M&A advisor, and not just to find buyers. Perhaps their biggest value is helping you negotiate the best deal. That means knowing what terms to ask for, identifying any red flags, and making sure the deal gets to the finish line.

A good advisor can also be a trusted partner that alleviates stress and workload for you throughout the process. Many founders who’ve sold say it was worth paying advisory fees for this support.

But we also see founders sell without an advisor. Sometimes they pitch their own buyer, and other times a buyer approaches them about a sale.

It’s common for 6 figure sales to happen without a broker, but we also see it sometimes for 7- or even 8-figure deals.

However, the bigger the deal, the more you should consider leaning on an advisor, because the more you have to lose.

Founders selling businesses under, say, $750,000, sometimes choose not to work with an advisor because at that size, you’d likely have to give up around 15% of the deal proceeds to your advisor partner. Which can feel like a lot for a 6-figure sale.

But we’ve talked with founders who’ve sold for less than that who were glad they used a broker.

When it comes to founders who wish they had not hired an advisor, most had a bad experience with the one they chose. This is why we offer a matching program to help you find an M&A advisor you can trust, one who comes recommended by other founders who’ve sold.

Cost-efficient alternatives to M&A advisors

If an M&A advisor is out of your budget or your business is too small (say, less than $300,000 in annual revenue) to warrant working with one, here are a few other ways you might sell your business.

Pitch buyers directly

Lots of founders do this successfully. The best way to drive up your sale price is to have multiple buyers who are interested.

Here are some examples of founders who’ve pitched their own buyer.

Sell on a marketplace

Popular marketplaces include Empire Flippers, Flippa, and Acquire.

Marketplaces typically take a lower commission than an advisor, but you have to do more of the legwork yourself, including vetting potential buyers and negotiating the deal.

Innovative models

Startups like Baton and ExitHero, which coaches founders through the process, offer lower fees. Just make sure the firm you work with has experience selling your type of business.

More ideas for working with an M&A advisor

When it comes to deciding whether to work with a broker, remember: a good one often helps you get a better price and terms, while making the process smoother and less stressful.

Focus on finding someone with experience selling businesses like yours and a fee structure that aligns with your goals.

If you’d like support with finding an M&A advisor who’s a good fit for your business size and type, we can help you choose one: Request an M&A advisor.

A few more resources that will help you navigate choosing an M&A advisor:

- Should you work with a broker to sell your business? Here’s what to expect

- Tips for vetting a broker

- Mistakes founders make when considering an M&A advisor

- How to sell without a broker