Accessory Dwelling Units are booming for many reasons.

This week I’m stepping away from digital assets to explore the world of ADUs.

Table of Contents

Is Buying a House a Good Investment?

This week, Sam Parr from The Hustle tweeted his controversial opinion that buying a home is not a good investment compared to alternatives:

If you’re in the wealth accumulation phase of your life, I think buying a home is a terrible decision (in most cases).

— Sam Parr ⚪️ (@theSamParr) August 8, 2020

Prove me wrong.

Seriously. I’m not being rhetorical.

I want to see if there’s math that says otherwise.

Like most takes on Twitter, this erupted into a firestorm of opinions from people on both sides of the fence. (Unlike most twitter firestorms, there were actually some really good, nuanced replies.)

It seems Sam’s main point was not that owning a home is a bad investment per se; but rather that the opportunity cost of a down payment could be better spent creating value or leverage elsewhere – for example, by starting a business.

While I agree that the opportunity cost of a down payment is often ignored in people’s “rent vs buy” calculations, what’s also often ignored is the fact that buying property provides immediate leverage & appreciation potential on the full amount of the loan.

Think about it: How many other ways are there for the average person to borrow money they don’t have, against assets they don’t yet own, and make an enormous investment at low interest rates?

And aside from homes, nobody gets lent 80% of the price to invest in something!

— ?? Stefan von Imhof (@stefanvonimhof) August 7, 2020

Can you imagine asking a bank for half a million dollars so you can put it in the stock market? The thought is absurd. Yet with real estate it’s the norm.

Let’s say you buy a $500,000 home with 20% down ($100k).

Assuming a 7% rate of appreciation, after 1 year you have gained $35,000 in appreciation ($28,000 of which was earned using levered money.) If you were to start a business with that $100k instead of buying a home, you’d need to earn a 35% return in your first year to match your real estate investment.

*Goes to bank*

— ???????? Stefan von Imhof (@stefanvonimhof) August 10, 2021

ME: Hi, can I borrow a million dollars? I’d like to buy some stocks.

LOAN OFFICER: No

ME: Oh, I meant a house. I’d like to buy a house.

LOAN OFFICER: Why yes! Come right this way.

(Of course, if you use that down payment to buy an existing business, you’re starting out on second base, and are far more likely to make or even exceed a 35% return. Which as you know is a huge part of what this newsletter is all about. But I digress…)

My point is, you might make 35%, sure. You might make even more than that if you’re good. You might also waste it all, and end up with nothing. There’s a million possibilities – none of which make buying a home a poor decision.

Sure, there are a few widely-available financial instruments that allow people to lever up on stocks if they so desire. (This is part of what Robinhood Gold offers.) But the only way for most Average Joes to get access to hundreds of thousands of dollars’ worth of margin is through a home mortgage. Which seems like a pretty significant fact to ignore when doing an ROI analysis.

Anyways, wherever you stand in this debate, there’s one residential real estate investment that is starting to become very appealing…

What are ADUs?

ADUs, or “Accessory Dwelling Units” are small residential units that are located within existing property lines. Also known as “Granny Flats,” or “In-Law Apartments”, or [INSERT SEO-OPTIMIZED TERM HERE], they are a powerful way to produce both cash flow and boost a home’s value.

The most popular examples are:

- Converting a garage (attached or detached) into a liveable apartment

- Building a small backyard house which sits on a foundation

- Renovating a basement

And boy, they are booming.

According to MReport, in 2000 just 1.6% of homes listed for sale included an ADU on the property. By 2019, this had more than quadrupled to 6.9%

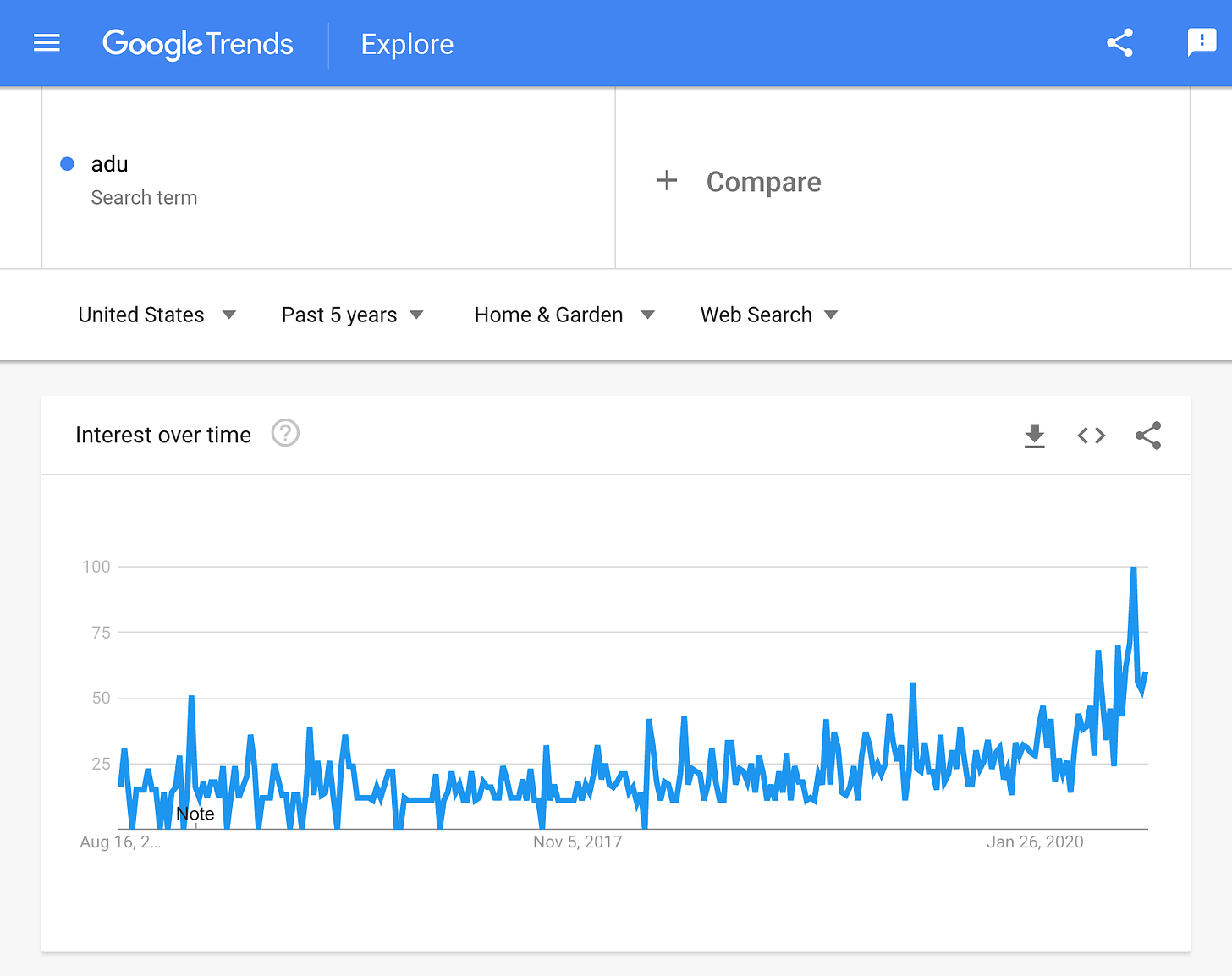

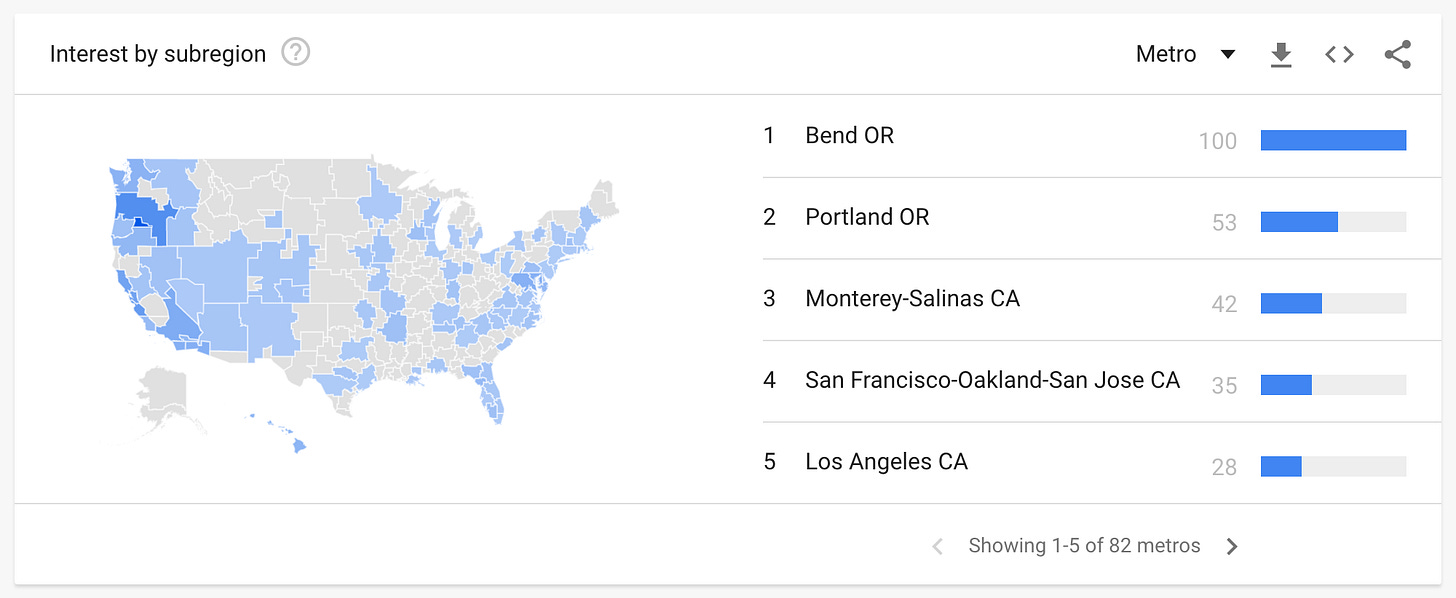

Interest in ADUs is greatest along the west coast, which makes sense given that Portland was the first city in America to allow ADUs back in 1997, and to this day is the most ADU-friendly city in the country. (More recently, Bend, Oregon has started to break away from the pack, as it has become a haven for new remote workers.)

Why are ADUs Becoming so Popular?

There are a bunch mega-trends converging to create this boom:

- Low-interest rates. Our new world of permanently-low lending rates pushes money into every conceivable nook & cranny throughout the economy. Including many new ones.

- Housing affordability crisis. The supply of housing is tight in major cities all around the world, but especially in the US. Infill housing is one solution to the housing crunch. California recently passed legislation forcing cities to relax previously strict rules around ADUs, and create plans for permitting them effective immediately.

- Sharing economy. ADUs are easily “Airbnb-able.” Vacationers like them because they are often unique, cozy, private, and have a lower nightly cost than hotels.

- Tiny house movement. Kickstarted by Jay Shafer, the movement has been gaining steam since the 2008 financial crisis kicked many people out of their homes, and has caught on with younger generations that increasingly value experiences higher than things.

- Work from home movement. COVID-19 has caused huge numbers of people to work from home. However, not everyone who works from home has a dedicated office. Many couples are finding themselves fighting over who gets to use the spare bedroom, and who has to use the kitchen table. The idea of building a new workspace out of thin air suddenly has tremendous appeal.

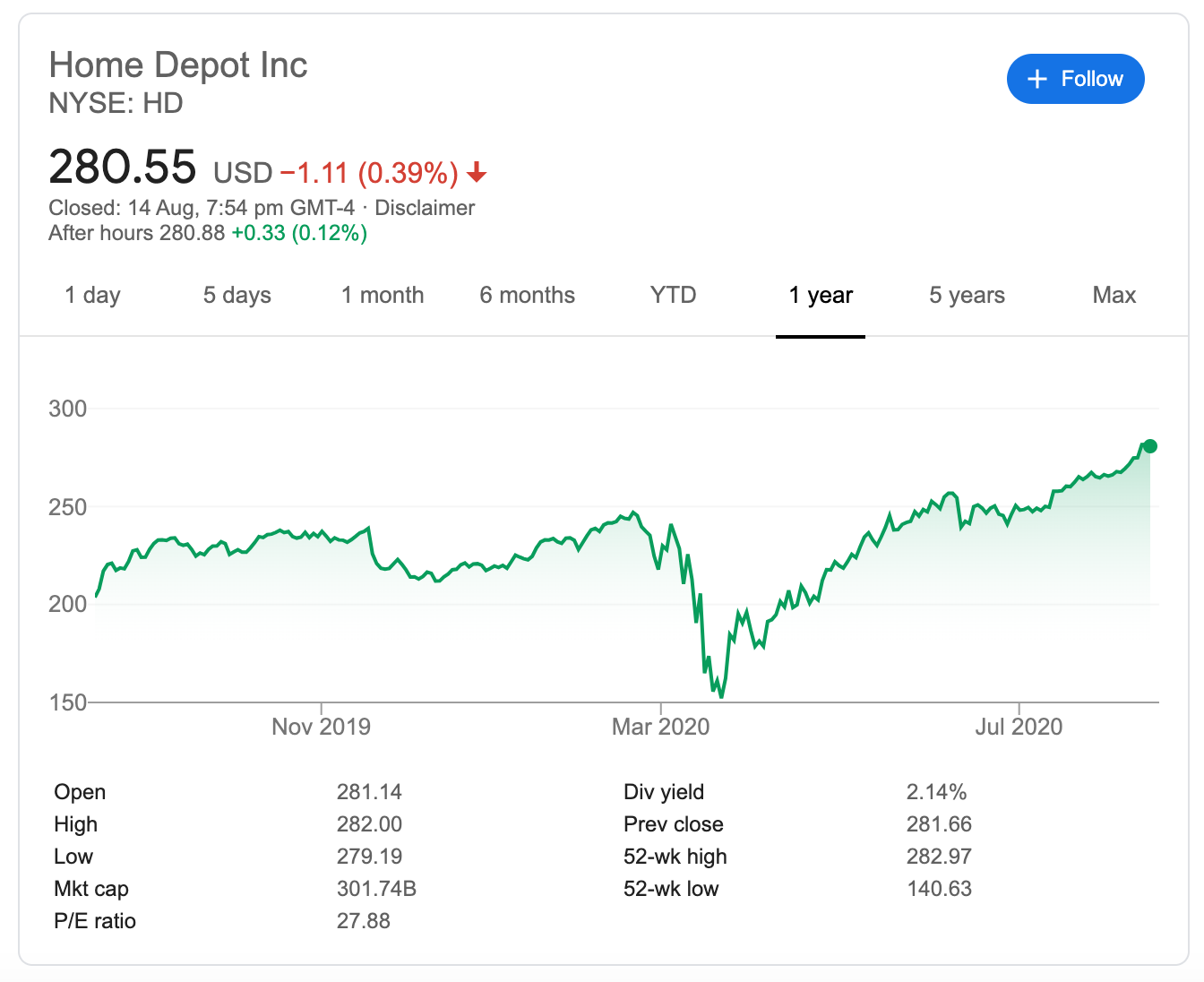

- Relief funds. What do you get when you combine being stuck at home all day with the CARES Act? Exactly what you’d expect: Bored consumers hammering away on home-improvement projects. Demand for home remodeling is strong, stocks of Home Depot are up 84% since the March lows, and with fewer restaurant & entertainment options, it makes sense that money would funnel into home improvement. (Heck, here in real estate-obsessed Australia we even have a Coronavirus Renovation Grant that gives homeowners AUD $25,000 to renovate their homes if they spend at least AUD $150,000!)

So it’s no wonder ADUs are so popular right now.

Now let’s break down the numbers.

How Much Value Does an ADU Typically Add?

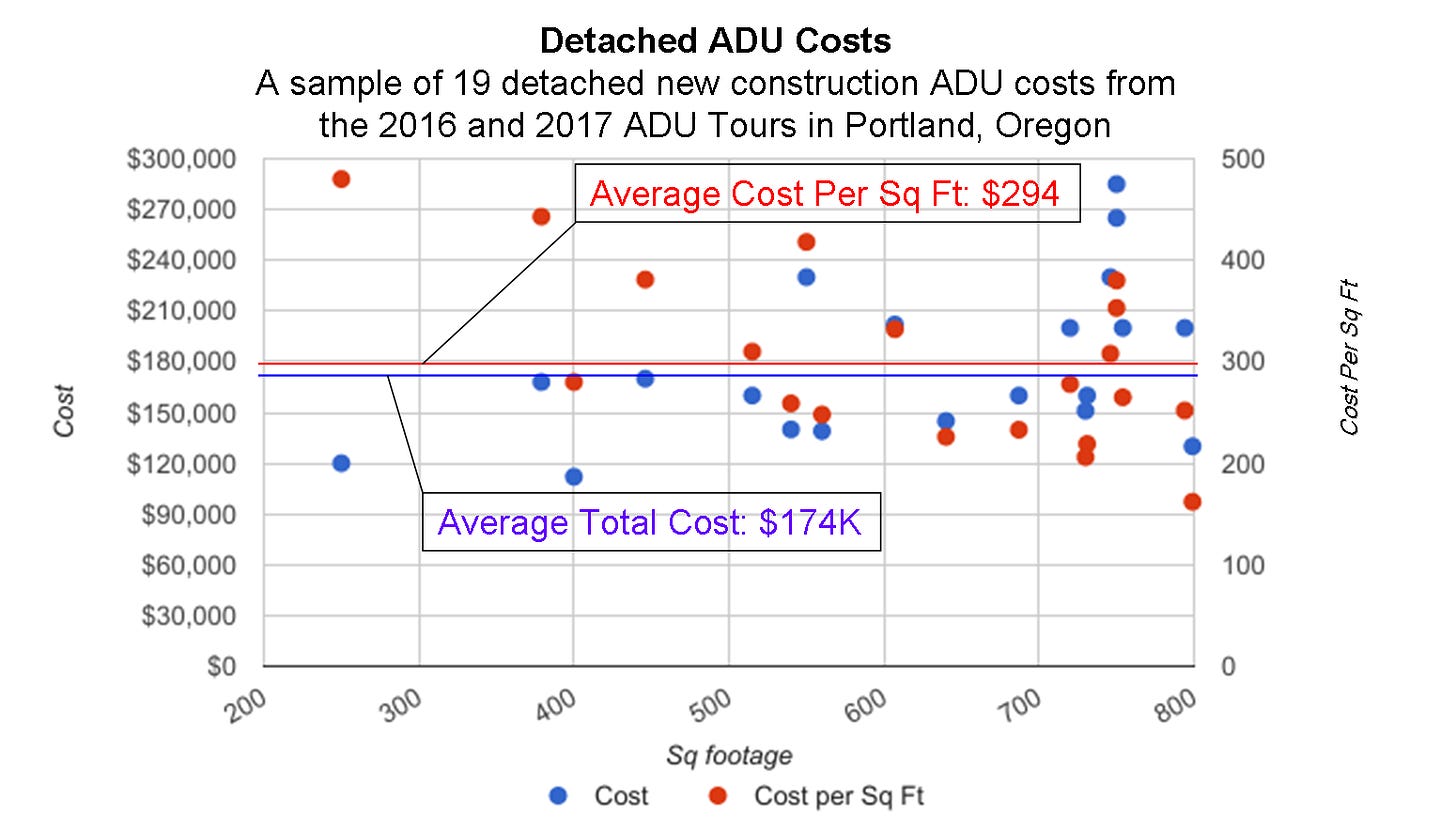

For the sake of simplicity, I’ll use Portland as my example city, and will only look at detached ADUs. Obviously the cost of housing, labor, and materials varies widely around the world. But Portland has the richest, longest-running data on ADUs, and is a reasonably-priced metro area to use as a benchmark.

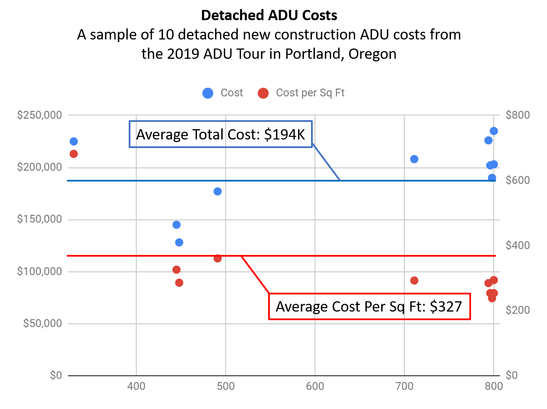

Cost to build

ADU costs are notoriously all over the map, and extremely difficult to nail down. According to an Oregon DEQ survey and data from buildinganadu.com, here are the average costs to build. These costs include all development costs, from design, permitting to construction, and everything in between.

In 2016, detached ADUs had the following costs:

- Avg sq ft: 591

- Avg total cost: $174,000

- Avg cost per sq ft: $294

But by 2019, the average costs had gone up:

- Avg sq ft: 593

- Avg total cost: $194,000

- Avg cost per sq ft: $327

As with so much else in the world, construction costs – labor and materials – are rising steeply.

Rental income

Generally speaking, rental income from an ADU will pay for itself within 3-10 years.

The average rent for a studio apartment in Portland is $1,200/month, and the average unit size is around 400 sq ft.

Given an average building cost of $327/sq ft, a 400 sq ft unit would cost $130,800 to build. At $14,400/year in rental income, this implies a payback period of 9 years.

Hmmm.. 9 years to recoup costs seems pretty high. To bring that number down you’d need to drastically cut development costs or put in some serious sweat equity. Luckily, there is another good reason to invest in an ADU.

Increasing home value

ADUs not only generate monthly income, but they also increase the resale value of your property.

If houses in your neighborhood typically sell for $425/sq ft, and you can build an ADU for $327/sq ft, then it’s an easy arbitrage opportunity. By adding 400 sq ft of liveable, rentable space to your property, you’ve effectively added $170,000 to the value of your home.

Using our example above: if the ADU cost $130,800 to build, you’d have an immediate unrealized gain of $39,200.

Applying this gain to your rental income would bring the effective building cost down to $91,600 (and thus the payback period down to 6.3 years.)

The ADU “sweet spot”

Frankly, Portland may be the epicenter of ADUs, but these numbers aren’t excellent. The best ADU investments are in places where both rental prices and property prices are high.

My wife and I just finished building an ADU in Southern California that cost $207/sq ft. The median price per square foot to buy a house in our neighborhood is around $700/sq ft. Given rental income, the payback period will be around 3.4 years. If you discount the immediate home value appreciation, the ADU has already paid for itself 3x over. (Note: This assumption is not actually wise, since as we all know housing markets can fluctuate widely.

Still, this is why ADUs make the most sense in high-cost, coastal areas. Yes, construction costs are high, but desirability is through the roof, rental inventory is tight, and the potential price arbitrage per square foot is pretty perfect (say that ten times fast).

It’ll always difficult to find the perfect trifecta of 1) Low construction costs, 2) High rental prices, and 3) High housing prices. But the closer you can get to that sweet spot, the better.

The ADU Startups are Coming

Startups are streamlining ADU construction to help solve the housing crisis (and carve out a piece of the action for themselves)

- Rent the Backyard is a Y-Combinator funded startup aiming to reduce paperwork and keep constructions costs down. Owners split the rent with the company over 30 years (yikes), at which point they own the ADU outright.

- Node makes “flatpack homes” – modular housing with pieces that can be quickly assembled in your backyard.

- Homestead offers zero-down financing, and promises to take the guesswork out of financing, design, and construction.

- United Dwelling operates in Los Angeles, and just raised $10 million. Homeowners can either lease the studio home to United Dwelling and receive a few hundred dollars a month, or buy out the property for $87,900 and have United Dwelling manage the property. Very interesting.

- Last but certainly not least, there are thousands of ADU Consultants popping up around the world, who are helping homeowners navigate the messy planning, paperwork, financing, construction, design, and hellish bureaucracy (which is no joke, believe me.) If you ask me, when it comes to an investment like this, there is no replacement for a personal touch. (And to Southern California readers – if you are interested in building an ADU I can recommend some fantastic folks!)