The Political Trap And Environmental Reward of High Oil Prices

Higher energy costs post a tough challenge for the Biden administration and American consumers alike though for different reasons. Read below to find out more…..

In Pebble No. 2 we discussed oil crossing above $70 and why higher energy costs might be here to stay as well as the consequences of pricier oil in a net zero emission world.

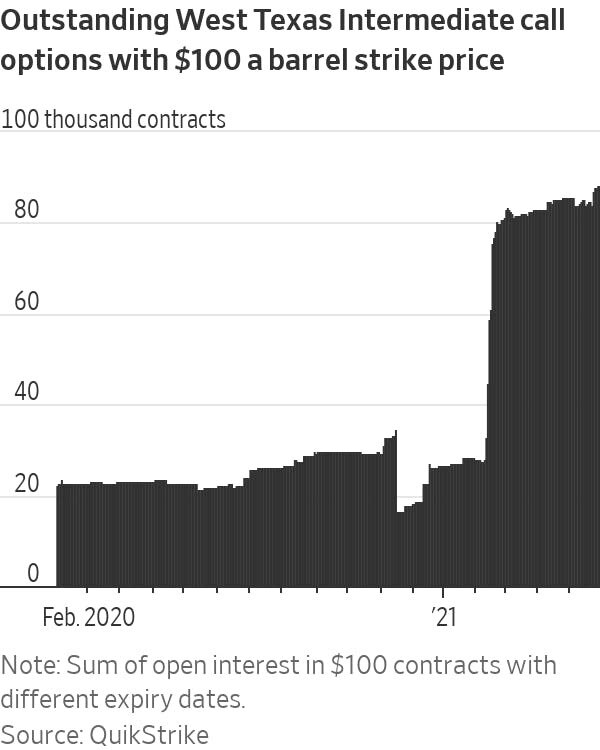

Well, the oil price continues to rise ($74-75) and some traders are betting on $100-a-barrel oil by the end of this year (see below). Could this prove helpful for renewable companies, including oil-turned-renewable energy enterprises?

More and more option contracts around the symbolic (and high!) $100 dollar price. This suggests more and more investors think it is becoming more likely.

Source: WSJ

Why $100 a barrel oil? Well, very simply:

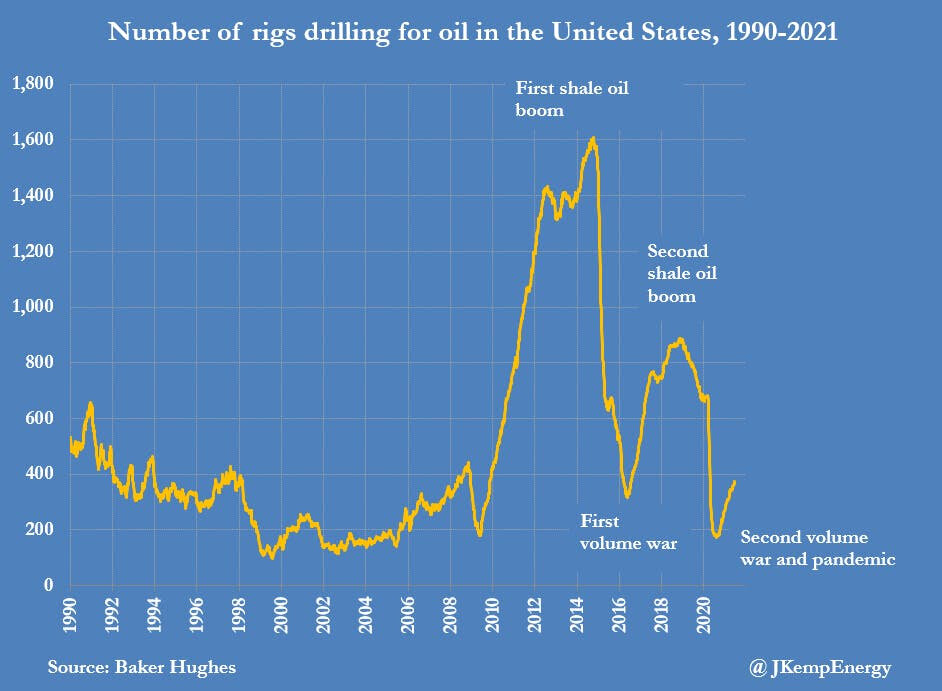

On the supply point, one of the puzzles about the current moment is that higher prices are not leading to a surge of new US drilling that would then bring a lot more supply.

US RIG COUNT rose +8 to 373 last week and is up by +201 from the low in Aug 2020, but still less than half the number the last time prices were above $70 per barrel.

The reasons for this are multifaceted but one of the unappreciated drivers might be the "green agenda" from President Biden's administration:

The President banned drilling on federal lands by executive order this past winter.

This combined with existing regulation and NIMBY-ism limits the number of pipelines and volume of oil that can be extracted and moved.

These factors and a tighter lending environment combined with a stock market that wants to see profits is keeping oil in the ground.

All of this helps oil and gas companies avoid a production glut and a sudden collapse in the price.

If this is true why would the climate friendly administration be okay with this?

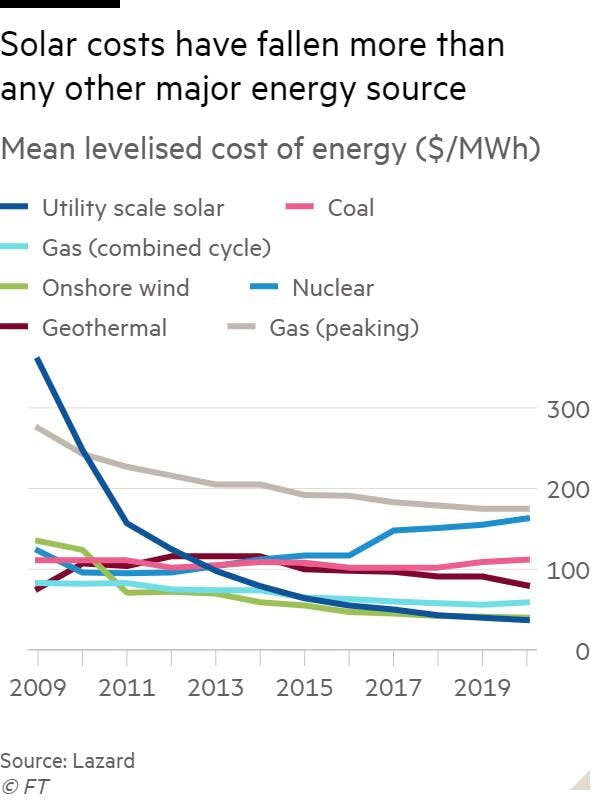

Well, perhaps because a high and sustained oil price makes renewables more competitive and leads to more investment in large renewable projects which, over time, leads to gradually lower costs for those projects and the crowding out of fossil fuels.

This is already happening. A new report by IRENA points out that:

Globally, the world added more than 260GW of renewables in 2020, compared with 60GW of fossil energy. This is big.

62% of the renewable power generation added last year cost less than the cheapest new fossil fuels.

So, higher oil (and gas) may be continue (and continue to hurt consumers' wallets) but it may pave the way for a greener future faster than we expect. Will energy companies use this moment to fund more renewable projects?