Are You a Line or a Dot?

In 2010, prolific investor Mark Suster wrote a blog post titled “Invest in Lines, Not Dots.” It was a response to the rapidly increasing pace of VC deals being done as the world emerged from the 2008 financial crisis.

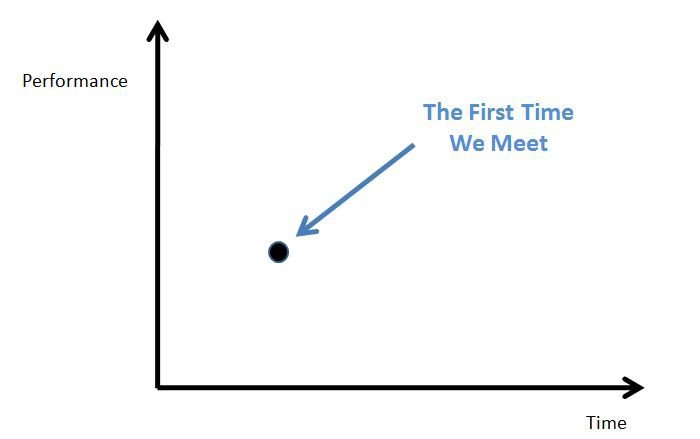

The premise was simple: each time an investor and founder meets is a dot. If an investor has only a single data point about you (one ‘dot’), it’s difficult for them to gain conviction on your ability to execute. The implication: if investors only meet you once (during your fundraise), they’re unlikely to invest in you. Therefore, you should meet investors early and often to provide them with additional dots.

Invest in Lines, Not Dots - Mark Suster, Both Sides of the Table

If that sounds like a one-sided argument, it’s because in many ways it was. Back in those days, most VCs were really uncomfortable making fast investment decisions. Investors had historically held all of the power in the fundraising dance and were used to being able to perform weeks or months of diligence before making a commitment.

But times were changing.

Accelerators like Y Combinator and Techstars had come on the scene and were pulling back the curtain on the mystique of VC. More significantly, they were creating fundraising playbooks for founders that were slowly but surely shifting power from investors to founders.

Y Combinator Batch #1

VCs the world over latched onto Mark’s post. “We invest in lines, not dots” became a rallying cry for investors desperate to maintain control over the fundraising process. Almost in unison, investors parroted a powerful warning at founders: “Investor-founder relationships last longer than most marriages. Having a bad investor could ruin your company, so you need to get to know us over time!”

The idea of a bad investor taking down a startup is the stuff of founder nightmares.

Now to be clear, when Mark wrote his original post, there was absolutely merit to this argument.

With the torrent of startup activity following the financial crisis, investors and founders alike were making rushed decisions. There were plenty of cautionary tales from both sides, but the damage was always felt more by founders who had the misfortune of dealing with bad investors (or investors with bad behavior). As a result, investor warnings were largely heeded.

But that was then, and this is now.

Evolve or Die

Over the past 10 years, the power dynamic has shifted more than ever towards founders. And in many respects, it’s a byproduct of the success of VC.

Since 2010, the number of VC firms has exploded, with over 1,000 early-stage firms in Silicon Valley alone. The result has been cut-throat competition, with founders the primary beneficiary. Investors in competitive ecosystems have had no choice but to improve, with speed of diligence the number one priority for top firms. The best VCs can now perform extensive diligence on a startup in a matter of days.

VC competition over a recent YC graduate

Twelve years later, you’ll rarely hear investors in Silicon Valley reference the need for “lines, not dots.”

Why not? Because today, it’s the closest thing you can get to an investor telling a founder outright, “You need to operate on my schedule, not yours.” And that’s not great for competitive positioning.

But outside of Silicon Valley…

If you’re an international founder, however, your pattern-matching radar should be going off 🚨. When you read or hear about ”lines, not dots” today, it’s almost exclusively from investors based outside of the US.

Why? Because of a lack of competition. Absent the level of cut-throat competition present in Silicon Valley, the vast majority of international investors haven’t developed the skillset necessary to perform adequate diligence and reach conviction quickly. Many simply aren’t equipped to make decisions in a rush and are willing to miss out on deals instead (which, to be clear, is the prudent thing to do for a good investor).

Founders Unite

Increasing competition amongst VCs isn’t the only reason why founders today are in a better position than in 2010. A significant change in the dynamic amongst founders has given them a major advantage over investors in one crucial area: references.

Historically, VCs have always had the advantage in this regard. Investors can rely on back-channel references from robust personal and professional networks when making investment decisions. Those reference calls still painted an incomplete picture (especially for investors diligencing first-time founders), but it was generally much better than what founders had: nothing.

Up until recently, when bad investor behavior occurred, founders were reticent to share the details publicly, lest they get blacklisted and their future career ruined. As a result, it was almost impossible for first-time founders with limited networks to reference-check potential investors. Thus, they had no choice but to buy into the argument that they should meet investors multiple times to get to know them.

But that was then…

The Little Black Book

Beyond the fundraising playbooks developed by Y Combinator, Techstars and others, the most significant shift in founder-investor power dynamics has come from the VC equivalent of a “little black book”: Crunchbase.

Imagine that you were thinking about getting married and had a list of every single ex that the other person had. That’s what Crunchbase is to founders.

The other thing today’s founder have? Peers who are willing to spill the beans.

All founders deeply understand the asymmetry that exists in fundraising. Most founders will only ever raise capital once or twice, while investors do this week in and week out. As such, members of the fellowship of founders are overwhelmingly willing to help each other out — especially when it comes to understanding investors.

To this day, I still get emails from founders titled “Founder Reference for X at Y Firm” in regards to investors in my prior company.

And I respond to every. single. one.

Today, it’s possible for founders to get an incredibly complete picture of a potential investor, including how they acted in both good and challenging situations. With a reasonably amount of work, founders can identify companies that succeeded, failed, blew up, and everything in between on a given investor’s watch. And in most cases, they can reach out to the founders for their side of the story.

So while it’s not possible to completely eliminate bad investor risk, with a reasonable amount of homework founders can bring almost to zero the risk of a surprise bad actor on the cap table.

That’s power.

The result? Notwithstanding trying to figure out whether or not you connect with a potential investor on a personal level (which is still really, really important), there’s virtually zero credibility to the argument that meeting an investor multiple times helps founders to avoid bad investor behavior.

Should You be a Line or a Dot?

At this point, you’re probably expecting me to tell you unequivocally that every startup should be a “dot”.

Not so fast.

If you’re in a position to run a high-velocity fundraising process, then presenting yourself as a dot (a single data point during fundraising), is likely to be the best approach for many founders.

But not every founder can do that.

There are situations where it is in your best interest as a founder to present investors with multiple data points so that they can build a line over time. These include:

Founders raising Pre-Seed or Seed funding in smaller ecosystems (where you have fewer investor options and most investors aren’t comfortable making fast decisions with limited information)

First-time founders without strong networks and/or prior experience working at a startup (in this case, meeting investors early can help you understand what they’re looking for at the same time it’s helping them get to know you)

Larger fundraises (once you get to a certain dollar amount, very few investors will make decisions off of a single dot)

There are other cases where I personally believe that presenting investors with a single dot is the best strategy. These include:

Founders raising a Pre-Seed or Seed round in Silicon Valley

Founders raising a round on a SAFE or similar instrument with no board seat or other terms involved (thus, minimizing the potential impact of bad investor behavior)

But there’s a third option which I believe provides a best-of-both-worlds approach for many founders: the dotted line.

Invest in…Dotted Lines?

Simply put, a dotted line is a hybrid fundraising strategy wherein most investors are presented with a dot while a select few get the benefit of a line.

How to Create a Dotted Line

Six months or more before your next fundraise, identify 5 – 10 target investors that would be your ideal lead. Reach out to them for an initial meeting (this is similar to Y Combinator’s coffee meeting strategy). Your goal as a founder for this meeting is to get input as to where you need to be when you kick off your fundraise to gain their interest. In return, you present them with a dot.

Over the next 6 months, touch base with them periodically. Share an update on your progress and ask if their expectations / benchmarks have changed.

By the time you’re ready to fundraise, three things should be true:

Assuming you’ve executed against the benchmarks shared by the investors, you should enter your fundraising process with confidence as to where you are in terms of investor expectations

Some number of your “preferred” investors have seen you execute over time (they have their “line”) and, if interested, will be able to move quickly with conviction

The majority of investors in your fully-research investor pipeline will have limited information about you, putting you at the advantage

From there, you can execute a high-velocity fundraising process with confidence.

Who Should Use a Dotted Line?

For founders trying to raise a Seed or Series A in Silicon Valley — particularly international founders who have previously not raised in the US - I believe that presenting a dotted line is the best approach for fundraising. It provides the confidence of knowing what VCs expect, while ensuring that you have the information advantage with the majority of potential investors.

One important caveat: if, in your early research, it becomes apparent that your metrics aren’t within the “strike zone” of what investors are looking for, you’ll likely want to revert to a line approach to increase your odds of investors building conviction.

At the end of the day, there’s a human element of fundraising that should not be overlooked: nobody likes to make a rushed decision (even if they’re capable of it).