Why the “Creator Economy” is Now Worth $104 Billion (and Counting…)

What’s Happening?

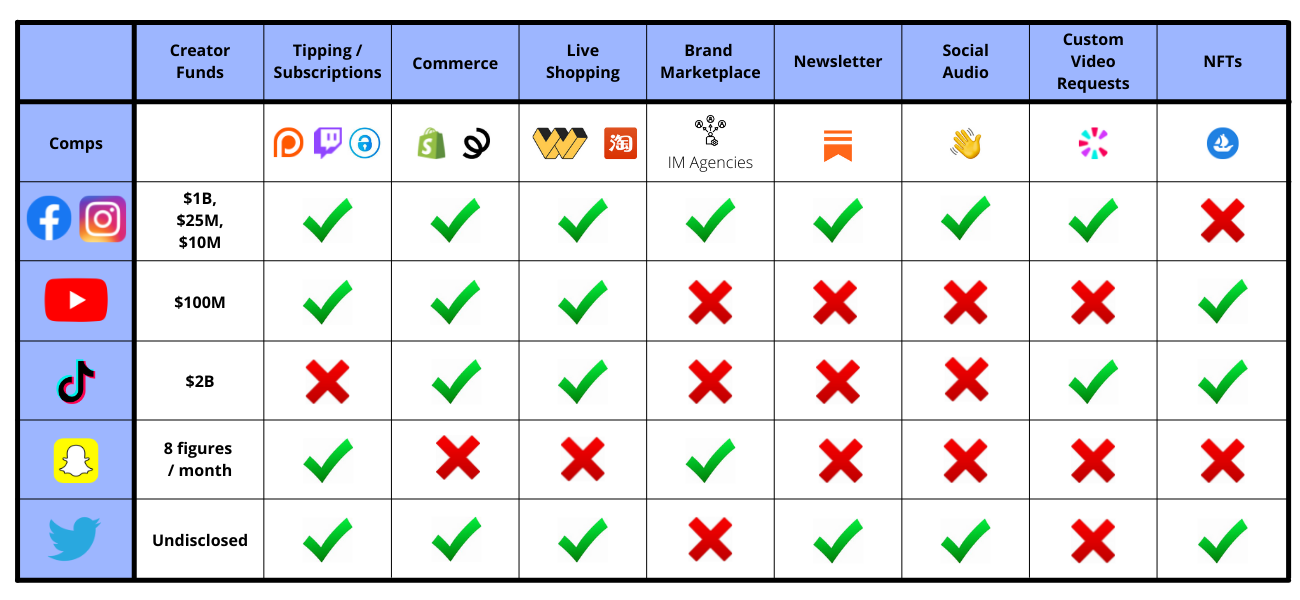

In addition to the 100+ Creator Economy startups that raised capital in 2021, top social platforms have also invested billions in funds and monetization products for the creator community. The most significant launches from the top 5 platforms are synthesized in the chart below, and the full list of 37 announcements can be found at the appendix at the bottom of this report.

We’ve tracked 17 creator funds from across the Creator Economy landscape. Check out the full “Watch List” linked here.

Why Is This Happening?

Platforms seek to bolster revenues by keeping creators (and thus their fans) on platform, and keeping “bottom-funnel” monetization within their platform ecosystems.

The Traditional Value Exchange Between Creators & Platforms

The traditional relationship between creators and incumbent social media platforms has typically been characterized by this simple tradeoff: The platforms offer the creators broad audience reach, while creators supply platforms with (mostly free) content to engage users on their platforms. Platforms monetize that scaled engagement through advertising. And although creators get a piece of that ad revenue, the true value they get from the social platforms is unprecedented access to audience reach and discovery. For creators, however, the opportunities to build real enterprise value occur downstream of social media.

In short, social media provides creators with “top-of-funnel” marketing, which they use to build fandoms that are monetized off-platform. In fact, the average creator only makes ~5% of total revenue from their share of social media advertising.

For example, although Barstool Sports has 140 million social followers, social ad revenues will represent a small minority of the $200 million that the company is projected to generate in 2021. About half of Barstool’s revenues come from non-advertising revenue streams, including:

- “Pink Whitney” vodka: $100+ million in gross sales over two years

- “One Bite” frozen pizzas: Sold 150,000 units in the first ten days

- “Barstool Bites” virtual restaurants opening in 300 markets across the country

- “Rough N’ Rowdy” boxing: Each event generates up to ~$2 million in PPV revenues

- Est. $60 million from merch sales

- Est. $10 million annual revenue from live events

This dynamic isn’t just true for established companies on social media, but for individual creators as well:

- Addison Rae (TikToker with 85+ million followers): 66% of her earnings come from branded merchandise. The rest comes from her brand sponsorship deals, her podcast, and her cosmetics line.

- Nelk (YouTuber group with 7+ million subscribers): Generated an estimated $70+ million in revenue per year from merch sales despite not receiving ad revenue from YouTube due to content guidelines.

- Ryan’s World (YouTuber with 30+ million subscribers): Generated $30 million in consumer products revenue in 2020, which was more than he generated from YouTube ads.

- Logan Paul (YouTuber with 23+ million subscribers): Merch brand, Maverick, generated an estimated $30-40 million in 2020. Recent blockbuster boxing match against Floyd Mayweather generated $50+ million in a single night.

The Democratization of the Bottom-Funnel: Birth of the “Creator Economy”

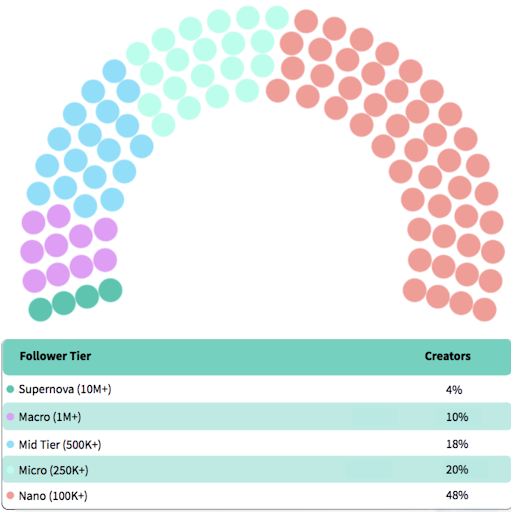

However, these mega-creators represent the minority of those that are supplying content to the major platforms. 68% of the 50+ million active US creators have fewer than 250,000 followers.

Source: Influencer Marketing Hub

The vast majority of creators don’t have the resources or infrastructure to power the blue-chip DTC commerce ventures that top creators are using to drive nine-figure revenues and / or enterprise value. For the average creator, 77% of their revenue comes from brand partnership deals.

That’s why over the past couple of years we’ve seen the emergence of companies and platforms that seek to democratize access to the infrastructure that empowers creator monetization.

AKA: The birth of the “Creator Economy”.

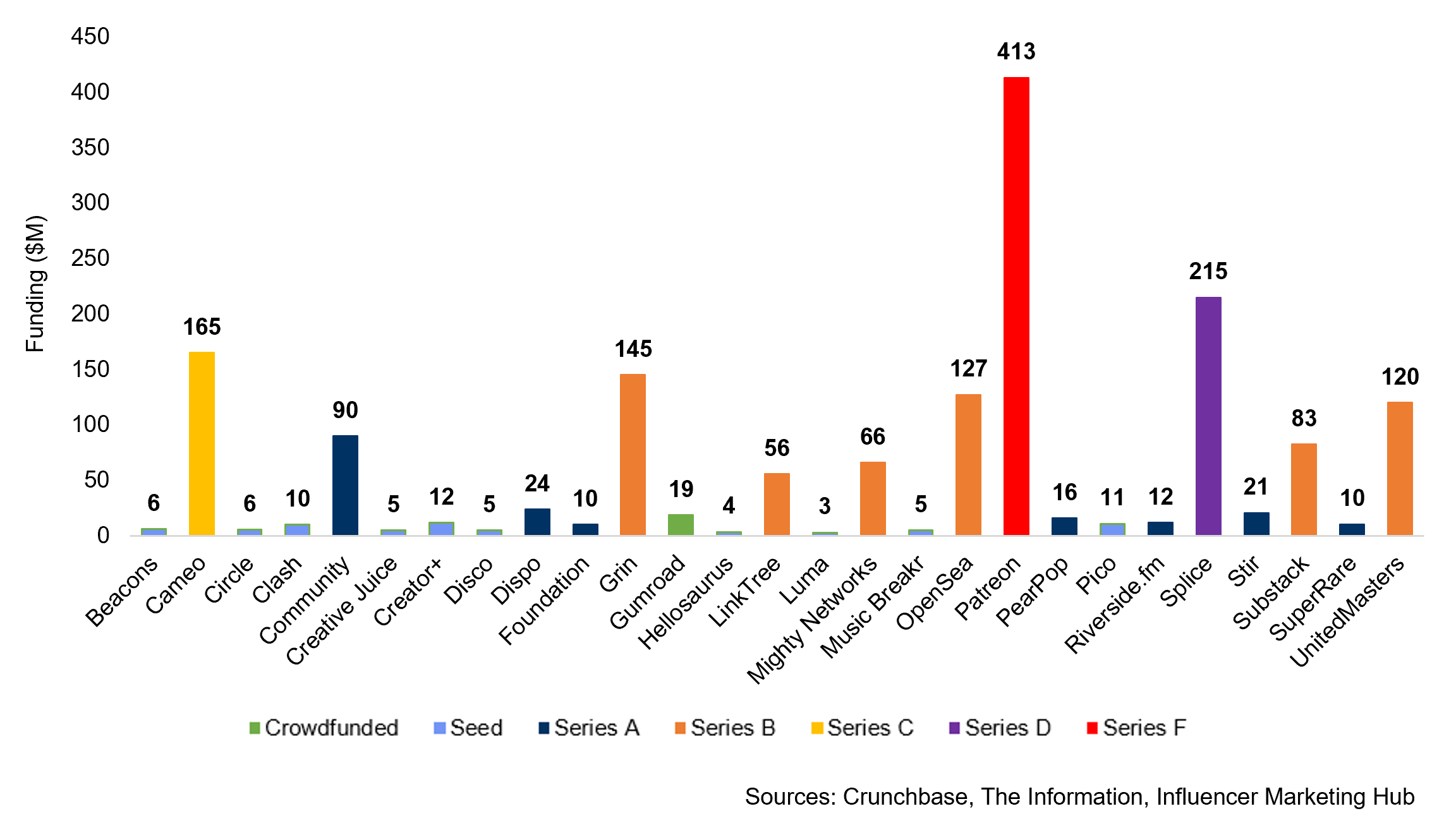

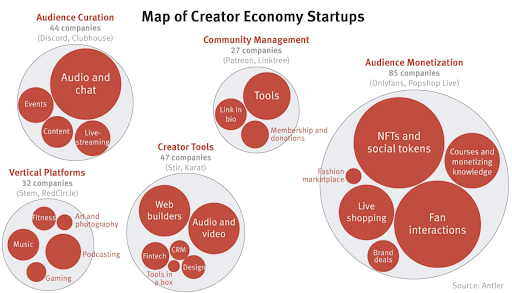

In the first ten months of 2021, $3.7 billion of investment capital has been poured into 100+ Creator Economy startups. That number is expected to reach $5 billion by the end of the year. And in total, there are now over 500 companies in the Creator Economy sector.

These emerging platforms function as bottom-funnel monetization engines that complement the powerful top-funnel marketing machines provided by the dominant social media platforms.

- Substack: 500,000 paid subscribers, and the top writers make well over $1 million annually

- Patreon: 200,000 creators → pays out $1 billion per year to its creator community

- OnlyFans: 85 million users in 2020 → paid out $1+ billion to creators

- Cameo: 100,000 new creators joined the platform in 2020 → Paid out $75 million to creators

- Stripe: 668,000 new creators used the service in 2021 (up 48% YoY) → $10 billion in total creator payments

- Spring: 7.7 million creators use its service → paid out $80 million to creators between 2018-2020 → $165 million in revenue projected for 2021

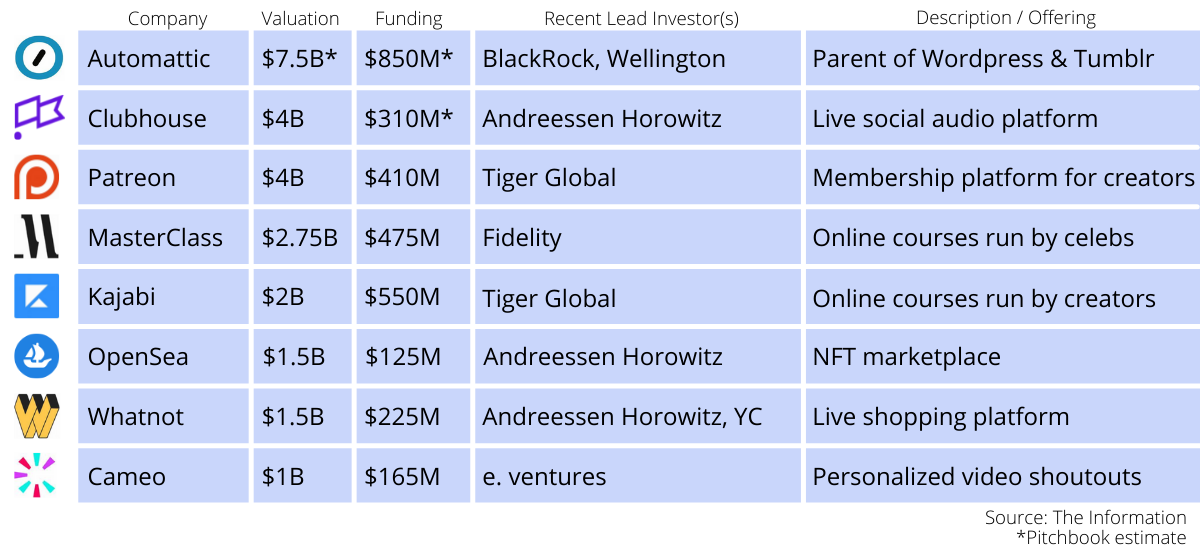

- WhatNot: “A couple thousand” live sellers on the platform → Gross Merchandising Volume up 30x since March 2021 → Valued at $1.5 billion

Unifying The Funnel

Collectively, these new platforms and services are growing at the expense of the incumbent social behemoths. These new platforms are not only incentivizing creators, and thus their fans, to spend less time creating and consuming content on the incumbent platforms, but they’re also generating significant revenues that the incumbents could be keeping within their ecosystems.

Large media companies and top-tier creators have already been building audiences on social media and monetizing them off-platform. But now, with these emerging creator-driven platforms and services, smaller creators (aka: the 96% of creators with under 10 million followers) are doing the same.

This is a major problem for the top social platforms.

Creators of all sizes are now using the major social platforms to build fandoms, and then using these emerging Creator Economy platforms and services to monetize them. That’s a leaky and disjointed funnel.

To combat this, incumbent platforms are intent on unifying that funnel before their competition does. The goal is to create an end-to-end solution for creators that empowers them to build audiences, engage them, and monetize them…all on one platform.

Unifying the funnel means: A) keeping creators and users in their ecosystems, thus maximizing the “top-funnel” ad revenues that their empires are built on, and B) capturing billions in incremental value by participating in the downstream revenues that they help generate for creators.

This process consists of:

1. Building or buying new products — often replications of the upstarts that are disrupting them — and integrating them into their existing UX

2. Investing in creator funds to drive creator payouts that are highly-publicized

For reference, we’ve compiled a database of examples at the bottom of this report, but let’s just take another look at how Facebook has manifested this strategy:

Facebook / Instagram’s New Product Launches (2020-2021):

- Launched self-publishing / monetization platform (Substack clone)

- Twitter did the same

- Launched a tool enabling fan subscriptions (OnlyFans clone)

- YouTube, Snap, and Twitter did the same

- Launched a tool to let fans pay creators to FaceTime (Cameo clone)

- TikTok did the same

- Launched a tool enabling users to tip creators (Patreon clone)

- Snap and YouTube did the same

- Launched social audio platform called Hotline with direct creator monetization features (Clubhouse clone)

- Twitter, LinkedIn, Reddit, Spotify did the same

- Launched livestream shopping (WhatNot / PopShop Live clone)

- YouTube and TikTok did the same (and Twitter has a product in development)

- Paid out $50 million to gaming creators in 2020 via “virtual stars” (Twitch clone)

- Expanded creator monetization on short-form “Reels” product (TikTok clone)

- YouTube, Snap, and TikTok did the same

- Launched Facebook Shop & Checkout to integrate commerce into the native content experience

- TikTok and YouTube introduced similar features

- Launched ticketed livestreaming (Wave / Moment House clone)

- Introduced monetization for on-demand gaming creators

Facebook / Instagram’s Creator Fund & Payouts (2021):

- Invested $1 billion in fund to be completely paid out to creators in 2021-2022

- Pledges not to take a cut out of creator revenues until 2023

If the billions of dollars in creator-driven investments don’t convince you that the mega platforms are committed to serving creators, just look at their org charts. In 2018, Amazon, Facebook, and Google had a combined zero employees with the word “creator” in their title…today, there are about 95,000 creator-focused roles across those three companies.

How Will This Trend Evolve Going Forward?

Emergent companies throughout the “creator stack” will race against the incumbents to “unify the funnel”.

The companies that provide monetization infrastructure to the creator community are now seeking to improve their “top-funnel” capabilities before the incumbents can build out their “bottom-funnel” functionality.

Companies that provide value across the “creator stack” are seeking to do what the major social platforms do best for creators: power audience growth and creator discovery. Simultaneously, they need to continue improving their creator-monetization solutions — all before the incumbents can fully replicate and integrate their offerings.

They’re doing this by investing in their creator communities — via dedicated funds with and through funding original content — in order to keep creators, and thus their fans, in the platforms’ ecosystems.

Content platforms:

- Clubhouse is funding slates of original programming.

- OnlyFans launched a creator fund for musicians to publish content on its platform.

DTC monetization services:

Payment solutions:

- PayPal was in late-stage talks to acquire Pinterest for $45 billion.

- Cash App launched a fund to invest in black creators, and launched Cash App Studios.

- LinkTree / Square launched a $250,000 “passion fund”.

- Square acquired Tidal for $300 million

E-Commerce platforms:

- Amazon launched an influencer program, and opens it up for livestream shopping creators

- Shopify launched a production studio

RockWater believes these investments will continue to proliferate.

However, these “bottom-funnel” stakeholders are disadvantaged in this race to close the content x commerce gap. Creators don’t want to build an audience in one place and monetize it in another. And regardless of how effective these investments are at incentivizing creators to publish content on their platforms, these emerging companies won’t reach the user scale of the incumbents. Substack has 500,000 users, but Facebook and Twitter, which are launching their own Substack clones, have 289 and 206 million users respectively.

So to supplement these content-driven investments, these platforms will need to:

A. Improve their UX with a focus on enhanced discovery so that creators can find new fans on these platforms — rather than just monetize their existing ones (Substack is already investing in these product features).

B. Continually innovate their bottom-funnel monetization features to stay a step ahead of the incumbents and remain “the place to be” for creators seeking best-in-class monetization solutions (e.g. Cameo acquired merch platform, Represent, to expand its in-house suite of creator monetization services).

C. Superserve a focused community of creators and fans, and expand into adjacent verticals from there. The incumbents can’t be everything to everyone. Different segments of creators and fans have different needs when it comes to optimizing a funnel from awareness > engagement > transaction. Twitch and Discord scaled from upstarts to behemoths by super-serving the gaming community. And although YouTube and Facebook were quick to replicate Twitch, they have yet to supplant it as the go-to platform to create and consume gaming livestreams.

Other platforms throughout the Creator Economy will need to follow that playbook: Substack’s content investment is focused on local journalists; OnlyFans broke through with adult content and now they’re seeking to scale by investing in music creators. What categories will be next? Music? Fitness? Education? The only playbook for maintaining a competitive moat against the incumbents will be specialization. No one company will overtake the incumbents alone, but their competitive advantage can be chipped away vertical by vertical (aka judo entry).

D. Understand that data is the most valuable currency. Based on our conversations with creators and their management, lack of data transparency is the most significant gripe that the creator community has with incumbent social platforms. To date, it’s been a necessary tradeoff. Creators sacrifice customer proximity in exchange for gaining audience scale. In fact, many creators that we’ve spoken with prefer to transact with fans on their own websites, rather than on the platform-native shopping portals, because they’d rather sell fewer items but have more access to customer data than sell higher volumes but continue to let the platforms own their customers. In the battle to recruit creators, providing access to fan data is an incredibly valuable carrot that emergent platforms can offer, and the incumbents won’t be willing to. Additionally, integrated solutions providers that work within the existing platform ecosystem to provide creators with increased data accessibility and customer proximity (e.g. LinkTree) could become a major new growth vertical within the Creator Economy.

E. The further down-funnel a service is, the more it should prioritize partnerships. One of the most common exercises we perform for our clients is a “Build / Buy / Partner” analysis. That’s because it’s an incredibly crucial decision that every business needs to make when scaling. For integrated solutions providers at the bottom of the funnel (e.g. e-commerce solutions like Shopify and Spring, and payment solutions like Stripe, Klarna, and PayPal), it’s especially difficult to acquire and retain scaled audiences that come to your platform to consume content. It’s also expensive — companies like Amazon and Square, and PayPal (if it acquires Pinterest) spend 8 to 11 figures to buy top-funnel audience access. On the other hand, content platforms want creators to fully monetize their fans within the platform’s ecosystem, but few are willing to spend the billions to own the entire stack like the Chinese “super apps” do (e.g. content, social, P2P messaging, supply chain, shipping, payment processing, etc).

For this reason, these companies can be friends, not foes, to the dominant content platforms — unlike destination platforms (e.g. OnlyFans, Cameo, Substack), which are directly competing with them for users and creators. That’s why Shopify has partnered with TikTok, Spotify, and Mailchimp. Spring has partnered with YouTube. WalMart has partnered with Barstool Sports, Netflix, and Buzzfeed. Tipalti has partnered with Twitch. And Stripe has partnered with 50+ creator economy platforms that have powered over $10 billion in payments to creators in 2021 alone.

Although commerce and payment solutions companies might take more bets on content in hopes of building their own communities of creators and fans, we expect the prevailing strategy of partnerships to persist.

Platforms need to better define goals and KPIs to optimize the performance of their creator funds.

Despite the fact that major platforms are pouring hundreds of millions (and in one case, a billion dollars) into creator funds, the playbook for operating a creator fund is still undefined.

In fact, it’s starting to feel like a game of Keeping Up With The Joneses playing out over a series of press releases.

In July 2020, TikTok announced it’s expanding its $200 million creator fund into a $1 billion fund for short-form video creators on its platform. Then, four months later, Snap announced it’s setting up a fund to pay out $1 million per day to short-form video creators. Then, six months later, YouTube announces a $100 million fund for short-form video creators. And two months later, Facebook / Instagram announced it’s launching a $1 billion creator fund.

Each one of these funds was meant to communicate the same message to the creator community: ‘Don’t leave us. We’re the most creator-friendly platform. We’re the best place to monetize your audience. Keep your content and your fans on our platform.’

Great start…but now what?

It’s not that money can’t solve the problem for the incumbents considering the core issue is creator monetization — putting money in creators’ pockets is the only way to solve the problem. But committing to large creator payouts is the easy part. The complex part is the how.

- How will payouts be allocated? Will they go to the 4% of creators that have over ten million followers? Or will they go to the 86% of creators with under a million followers? Will a lot of creators make a little money, or will a small number of creators make a lot of money?

- How will platforms measure ROI on these funds? What’s the relative value of spending $1 billion on creator payouts vs. using that to invest in more tools and services that help creators make money on your platform? How will these funds integrate with their other creator initiatives, and with their overall platform strategies?

- What type of behavior do platforms want to incent through these payouts? What are the KPI’s they’re optimizing for?

- What is the long-term vision for these funds? Once the fund is paid out, then what? How will success be measured?

We expect these questions to be answered, and for these funds to be optimized, through a process of trial and error. Because the Creator Economy has been accelerating so quickly ($5 billion in investments projected for 2021 alone), the well-capitalized incumbents might have been forced to set sail before the ships were built and the course was mapped out.

We’ve already seen some of this retooling happening on the fly. Snap recently had to announce that its pledge to pay out $1 million per day to creators was being refined to pay out “millions per month”. It also adapted the format of the fund in order to incentivize creators to publish more original and innovative content on its platform by removing the emphasis on metrics like views and engagement, and instead basing it on the ability to complete certain “challenges” defined by the platform.

We expect similar “retooling” to persist until each platform has found its own sweet spot. And we don’t expect a one-size-fits-all model to emerge for creator funds.

What works for short-form video platforms might be different than what works for audio platforms and livestream video platforms. What works for macro creators might be different than what works for publishers and micro creators. What works to incentivize content creation might not work to incentivize commerce activation. And so on…

Regardless of how each fund takes shape, platforms won’t throw good money after bad. “Keeping up with the Jones’” is one thing, but without implementing accountability and transparency, the “creator fund wars” will be a race to the bottom.

New verticals will evolve to add massive value to the Creator Economy

Audio:

The types of creators that reap the most benefits from the Creator Economy are those that go narrow but deep. Meaning, they don’t reach a broad enough audience to make a killing from ad revenues, but the fans that they do reach are engaged, passionate, loyal…and most importantly, eager to make purchases that are influenced by, or in support of, that creator.

This profile is highly aligned with the ethos of the podcasting community.

Ben Thompson explains why audio creates the most intimate relationship between creators and their fans:

“Podcasts, even more than blogs, require a commitment on the part of the listener, but that commitment is rewarded by a connection to the podcast host that feels even more authentic”

Tom Webster, SVP at Edison Research, adds:

“Podcasting has become the greatest companion medium because you can listen to a podcast and it can be a friend.”

This intimate creator-to-fan relationship has fueled the growth in podcast monetization. From the exploding podcast advertising market (podcast ad reads are 4.5x more valuable than banner ads and the total ad spend is projected to increase 55% in 2021), to derivative revenues like merch, touring / live events, the value of audio springs from the unique level of audience connection that the medium evokes.

This dynamic perfectly sets up the community of podcast creators to tap into the Creator Economy. And it’s already beginning. In fact, of all the creators that are active on Patreon, podcasters generate the most revenue. Top audio creators on Patreon make $30k per month, which is roughly twice as much as the next most lucrative category.

Platforms like Clubhouse, Spotify, Facebook, and Twitter have already introduced monetization around live audio (e.g. tipping and ticketed events). Considering that on-demand podcasts represent the vast majority of consumption, we expect to see more platforms uniquely cater to these creators. Spotify recently partnered with Shopify to enable its podcast creators to sell their merch directly through the platform. That’s a great start. How will Facebook, Apple, Amazon — and other platforms with ambitions of recruiting podcasters and their fans — respond?

Food & Beverage:

Food & Beverage is now viewed as an extension of lifestyle. Consequently, the 9-figure F&B commerce empires are no longer limited to celebrity chefs. From “ghost kitchens” to branded vodkas, F&B commerce initiatives have proven to drive a disproportionate volume of creator-led commerce revenue relative to other categories.

These creator-led F&B ventures generally manifest across four main categories:

- Branded CPG Products like MeatEater selling out of its branded whiskey line in under a week, or Complex generating $10+ million in annual revenue through its “Hot Ones” hot sauce line.

- Digitally-Powered Food Experiences like Mr. Beast’s ghost kitchen-powered chain of app-based virtual burger restaurants, which has a projected revenue potential of $300 million, or Barstool Sports’ “One Bite” pizza delivery app, which processed 100,000+ transactions in its first month.

- IRL Food Experiences like the signature Travis Scott menu offering at McDonalds, which increased same store sales by 5%+, or Time Out’s food halls which generated $56 million in 2019.

- Cookware & Kitchen Accessories like Food52 selling $40 million of products through its marketplace, or Buzzfeed’s food vertical, Tasty, which has sold 5 million units of its branded cookware products through its Walmart partnership.

As brands and creators seek to expand into new verticals and decrease their reliance on advertising revenues, F&B will become an increasingly valuable space. And within this space, we expect creators to evolve from the licensing model (wherein they only receive about 3-7% of the revenues), to an owned-and-operated approach that empowers them to drive significant revenues and enterprise value. However, we’ve worked with well-resourced media brands that see the high upside of F&B products, but don’t have the expertise or infrastructure to scale an owned-and-operated F&B venture, so they default to the licensing model.

So if food is the new merch, who is the Spring of F&B?

Creators need a turnkey solution. Companies like Mattson, PopChew, Virtual Dining Concepts, and even Patreon are doing great work in the space. As the market for traditional merch saturates, and creators look for the next frontier of fan-monetization, we expect to see outsized growth from companies enabling F&B activations.

NFT’s:

Given the central premise of the Creator Economy — providing a democratized marketplace for creators to monetize their most loyal fans, and for fans to transact directly with their favorite creators — NFT’s are an inevitable next step in its evolution.

Reddit, which wants to build the world’s biggest Creator Economy through developing its own NFT platform, explained in a recent post:

“Fans of today’s biggest creators and brands are now flocking to buy digital goods directly from them — to support them, to gain exclusive access, and to feel a greater sense of connection with them. Over time, we believe this will only grow, and NFTs will play a central role in how fans support their favorite creators and communities…Our [aim is] to build the largest creator economy on the internet, powered by independent creators, digital goods, and NFTs,”

Reddit isn’t alone in its thesis that NFT’s will unlock the next wave of growth for the Creator Economy.

- TikTok recently launched a creator-led NFT collection (TikTok announced that “Proceeds will largely go directly to the creators and NFT artists involved”)

- OpenSea, a creator-led NFT marketplace, raised a $100 million Series B at a $1.5 billion valuation.

- After raising at a $1.5 billion valuation, the top US livestream shopping startup, Whatnot, announced it will be introducing NFT’s into its creator-driven marketplace.

- Candy Digital, which is an NFT marketplace for sports fans to buy digital collectibles from their favorite teams and athletes, just raised a $100 million Series A at a $1.5 billion valuation.

With NFT’s, creators can now extend the monetization of their fandoms into the virtual realm. Will incumbent platforms capture this value via the Reddit playbook (building out an in-house NFT platform), or will an emerging company like OpenSea become the Shopify / Spring of the digital product sector, and partner with top social platforms to integrate into their existing UX? Either way, you can’t talk about the evolution of the Creator Economy without talking about the role that NFT’s will have on shaping it.

Livestream:

Investments in creator monetization flow towards the mediums that drive the most high-value consumption.

After the explosion of TikTok, short-form video became a priority for competing platforms. So in addition to launching their own short-form TikTok clones, Snap and YouTube each launched 9-figure funds for short-form video creators, and Facebook / Instagram introduced new ways for creators to monetize short-form videos (commerce integrations & rev shares from ads).

When Clubhouse exploded the same process unfolded. Each incumbent launched their own Clubhouse competitor, some launched dedicated creator funds and others launched dedicated monetization tools to recruit social audio creators to their ecosystems.

We believe that livestream video, and specifically livestream shopping, will be the next big thing in American commerce. In China, livestream shopping is currently a $300 billion market. By 2025, it’s expected to hit $726 billion. In the US, it’s worth $11 billion, but by 2023 it’s expected to reach $25 billion (a 124% CAGR from 2019).

In hopes of replicating the success of livestream shopping in China, and own the future of the US market, both upstarts and incumbents have launched products in the space. We’ve tracked $15.8 billion in global investment capital pouring into livestream shopping platforms. In the US, a few are already emerging as market leaders:

- Whatnot: $1.5 billion valuation

- Bambauser: $600 million valuation

- NTWRK: estimated valuation of ~$400-500 million

- PopShop Live: $100 million valuation

Meanwhile, mega platforms like YouTube, Facebook / Instagram, TikTok, Twitch, Amazon, and even Twitter all have livestream shopping products in various stages of development.

We expect the “Livestream Shopping Wars” to mirror the dynamics of the “Creator Economy Wars” at large: When one or more of the upstart platforms recruit a critical mass of creators, users, and revenues — like we saw with OnlyFans, Patreon, Clubhouse, Substack, etc… — the incumbents will go all-in. They’ll launch nine-figure creator funds, and invest in dedicated creator tools for the livestream selling community (e.g. creator-product marketplaces, gamification, product detection, on-platform marketing / discovery, funding original content and shopping festivals, NFT’s / virtual products, etc.).

Like with other sectors of the Creator Economy, the incumbents are at an inherent advantage because creators would prefer to not have to move their audience to a new platform. But if the upstarts can help them drive revenues in ways the incumbents can’t, then influential creators will migrate to platforms like Whatnot and NTWRK for live commerce, just like they fled to Substack and OnlyFans in the past. As always, it will come down to a race between the well-capitalized and hyper-focused upstarts, vs. the even-better-capitalized incumbents, which are engaged in an ever-expanding war on all fronts.

Likely, there’s room for more than one winner in this space, but we expect to see billions more invested before it’s all said and done.

Interested in RockWater’s Strategic Advisory Services? Click Here to Learn More About What We Do….

Interested in Reading More About The Creator Economy? Check out our “Greatest Hits” Below…

General Creator Economy:

- From 9-Figure Cash Grabs to Redefining Sport: The Evolution of Creator Competitions

- Why Only 10% of Beauty Sales are Online, and How to Fix the Consumer “Trust Gap”

Livestream Commerce:

- Can the US Replicate China’s $63 billion Livestream Shopping Industry?

- Winning in Livestream Shopping: The RockWater Playbook (Part 2/2)

- Why Every Brand Needs a Livestream Media and Selling Strategy in 2021

- 2021 Predictions: How to Close the $150 Billion Livestream Commerce Gap Between US-China

- Livestream Commerce Watch List

Food Media & Commerce:

- Time Out, MeatEater, NY Times, Complex: The Role of Commerce in Food Media

- What COVID-19 Means for the Future of the Dining Ecosystem

- 2021 Predictions: Food Commerce Gets “Re-stacked”

- Food Media x Commerce Watch List

Social Audio:

- The Duality of Social Audio: Leaning In While Leaning Back

- The Duality of Social Audio Part 2: How will the landscape unfold?

—

APPENDIX:

Facebook / Instagram:

- January 2018: Launched a tool enabling users to tip creators

- June 2018: Launched marketplace to connect creators with brand marketers

- November 2018: Launched a tool enabling fan subscriptions

- August 2020: Launched $10 million creator fund to support black creators

- August 2020: Launched Facebook Shop & Checkout to integrate commerce into the native content experience

- August 2020: Launched ticketed livestreaming (Wave / Moment House clone)

- March 2021: Expanded to 24 countries

- January 2021: Paid out $50 million to gaming creators in 2020 via “virtual stars”

- February 2021: Launched a tool to let fans pay creators to FaceTime

- March 2021: Launched self-publishing / monetization platform (Substack clone)

- March 2021: Expanded creator monetization on short-form “Reels” product

- April 2021: Launched social audio platform called Hotline with direct creator monetization features

- May 2021: Launched livestream shopping

- May 2021: Introduced monetization for on-demand gaming creators

- July 2021: Launched $1 billion creator fund

- October 2021: Launched $10 million creator fund for VR

Twitter:

- January 2021: Acquired social audio app called Breaker, launches live audio feature called “Spaces”

- January 2021: Acquired subscription newsletter platform called Revue and integrates with Twitter’s UX

- July 2021: Launched Shop Module for Twitter users to showcase and sell products on profiles

- August 2021: Launched Ticketed Spaces

- September 2021: Launches a creator fund (amount unspecified)

- September 2021: Launched “Super Follow” subscriptions

- October 2021: Announced it will be launching livestream shopping

TikTok:

- July 2020: Launches $200 million creator fund

- December 2020: Launched livestream video shopping

- July 2021: Expanded its creator fund to $2 billion

- July 2021: Introducing a feature letting users request / purchase custom videos from creators (Cameo clone)

- August 2021: Launched commerce integrations via Shopify partnership

- September 2021: Launched creator-driven NFT marketplace

YouTube:

- March 2021: Partnered with Spring to integrate “merch shelves” into video content for creators

- July 2021: Launched livestream shopping

- July 2021: Launched “Super Thanks,” a tool to let fans tip creators for uploaded videos

- August 2021: Launched $100 million creator fund for short-form video

Snap:

- March 2021: Launched a $1 million per day creator fund

- May 2021: Launched a marketplace to connect creators with brands

- May 2021: Launched gifting feature by which followers can tip creators

- August 2021: Revamps its creator fund to pay out “millions per month”

—

Ping us here at anytime. We love to hear from our readers.